COULD A DIFFERENT STRATEGY COST LESS AND MAKE MORE MONEY?

Here are the actual numbers from the most reliable source in the U.S. to provide incentive and backup as to how to spend your time and money on fundraising:

From Giving USA: The Numbers for 2015 Charitable Giving by Source:

Of the $373.25 Billion Dollars Donated:

Bequests………………………. 9%

Corporations…………………. 5%

Individuals…………………….71%

Foundations………………….16%

A simple question: How much time are you spending on soliciting bequests and how much time are you spending on seeking corporate donations?

According to the software company Blackbaud, “Once a planned giving program is established, nonprofits can expect a cost of 3¢ to 15¢ per $1 raised. This cost-to-donation ratio is important, not only to the organization, but also to the donors who want their gifts to make a difference in the world instead of being spent on additional fundraising efforts. Historically, planned gifts have increased nearly 5% every year even in recessions, while other sources of revenue decline in times of economic struggle.

I believe that we continue to want to give all the time, and during a recession, many of us want to give more than ever because we might be struggling or family and friends are having a rough time.

Just think about your own personal resources. Do you have the most money in:

1. Cash?

2. Real estate?

3. Other investments such as stocks and bonds?

4. Insurance policies?

1. Cash?

2. Real estate?

3. Other investments such as stocks and bonds?

4. Insurance policies?

Most of us have the least amount in cash. In fact, only 10% of the wealth in the United States is in cash. When you ask for a cash gift, even if it is quite large, for the clear majority of Americans, it will not be as much as you will get in a planned gift.

How much should you expect? The average charitable bequest in the U.S. is $35,000-$70,000. However, this is by no means a not a one-size-fits-all proposition, which is why research and strategy are so important. The major factor in the size of most gifts is the value of real estate. A mid-century 1800 square foot house in Hannibal, MO has a far different value than the same structure in Malibu.

Rule of thumb:

A Planned Giving target gift amount is 200 times a donor’s largest annual gift

$1,000 =$200,000 (Plannedgiving.com, 2017)

Just think about it. The average planned gift is 200 times an annual gift. I don’t know about you, but I find that stunning.

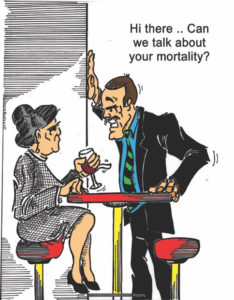

Why don’t Board and staff ask for planned gifts. It is simple: They have no training in how to do it. Talking about someone else’s death can be a challenging conversation. If you don’t have a planned giving program, perhaps it is time to start. If your board and staff are not trained in how to ask for a gift, perhaps it is time to call me!

I need CAROL to…

Pages

- Articles About Fundraising

- 2 Minute Feasibility Study

- 5 Ways to Guarantee Your Development Staff Leave in Under Two Years

- A Great Auction Idea

- All About the Cold Hard Facts

- Ask For What You Want

- Donor Stewardship in The Year of the Plague

- Giving Societies

- High-Tech Fundraising

- Mission Trips: Mission, Mingling and Money

- Naming Opportunities… How Much and For How Long?

- The 7th Child

- The Champion Approach to Planned Giving

- The Pin and the Grammar Symbol

- Touring for Dollars

- When Your Child Has a Fundraising Project

- Blog

- Fundraising

- Fundraising Coaching

- Fundraising Plans

- Fundraising Retreats

- Fundraising Speaking

- Fundraising Webinars

- Home

- Planned Giving

- Volunteer Topics